Thriday is for sole traders and small business owners who want to easily manage their financial admin from one place and save time.

Every business needs to send and receive money.

Every business needs to know where its money is coming from and where it's going.

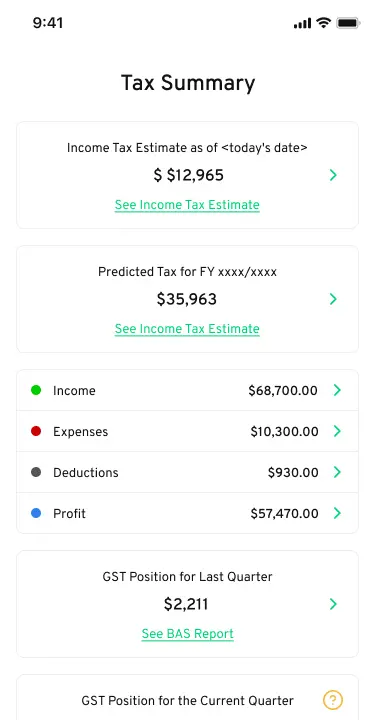

Every business must comply with tax regulations and pay the appropriate amount of tax every quarter and every year.

Thriday combines all of these features into one easy-to-use platform you can use on the web or app:

- Business transaction accounts

- Quoting

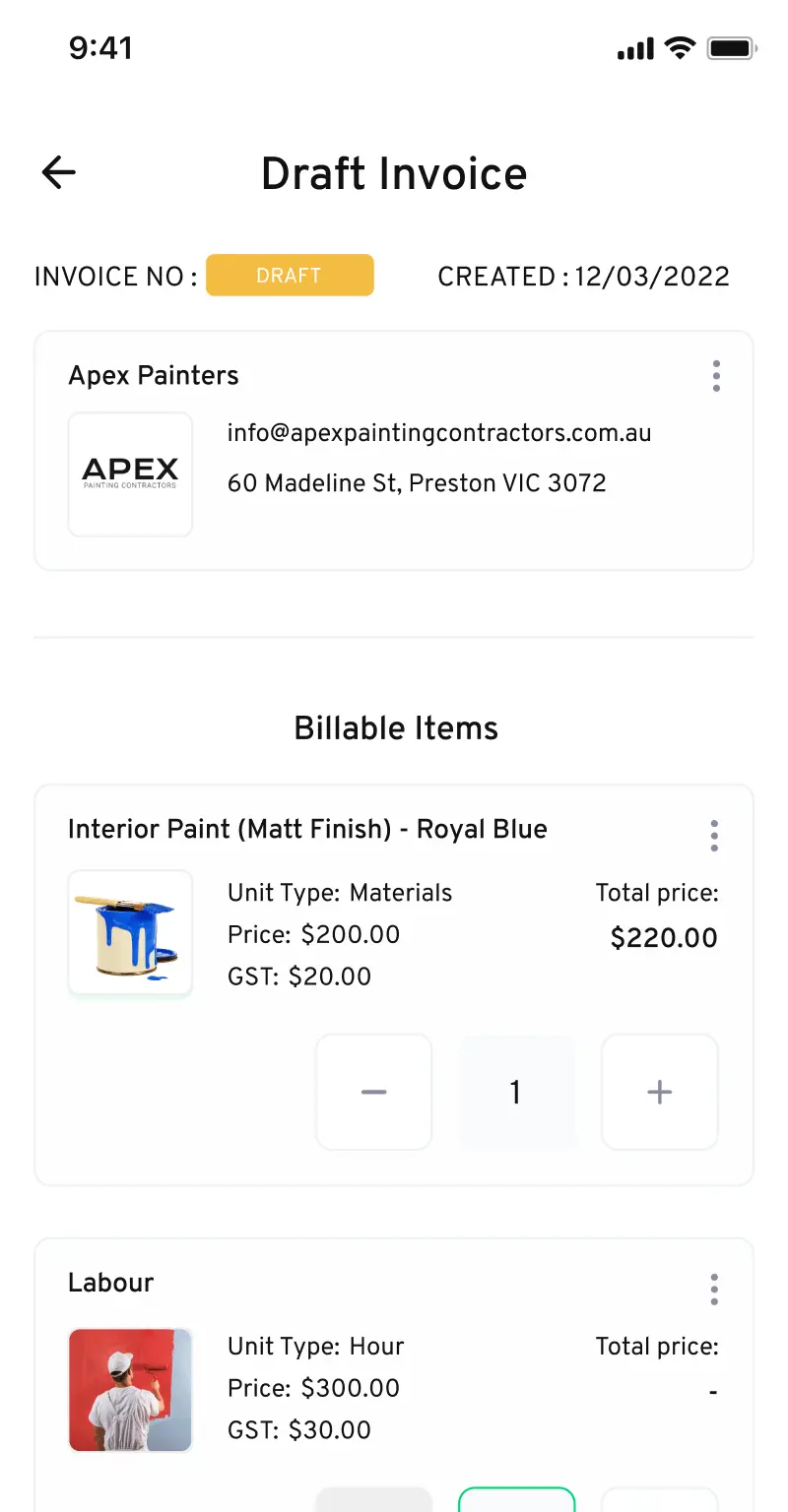

- Invoicing

- Receipt scanning

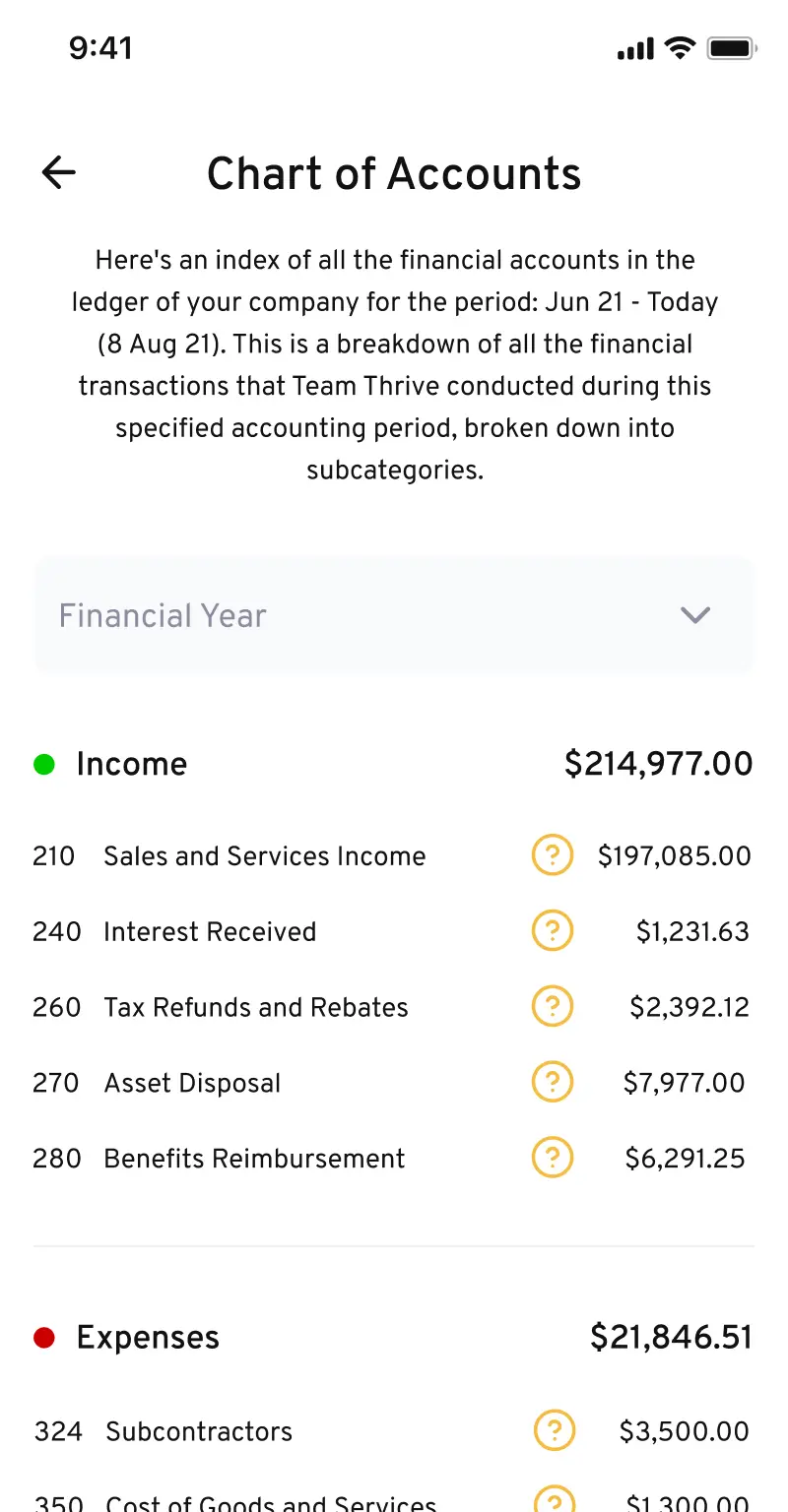

- Bookkeeping

- Accounting

- and tax

We've built Thriday from the ground up, consulting many small business owners along the way with the core objective of making their lives easier and saving them time.

.webp)