How to Grow Profit as a Broker

As a broker, your main goal is to grow your profit and achieve success in the industry. In order to do so, it is essential to understand the basics of brokerage profit and the key factors that can affect it. Additionally, implementing effective strategies, managing risks, building strong client relationships, and staying updated with market trends are all crucial elements for maximising your profit potential.

Understanding the Basics of Brokerage Profit

The Role of a Broker

Before diving into the world of brokerage profit, it is important to have a clear understanding of the role you play as a broker. As a mediator between buyers and sellers, you facilitate transactions and earn a commission on each successful deal. By providing expert advice and guidance to your clients, you add value to their investment decisions, ultimately boosting your own profit.

Being a broker requires a deep understanding of the financial markets and the ability to analyse market trends. You need to stay updated with the latest news and developments in the industry to provide accurate and timely information to your clients. Building strong relationships with both buyers and sellers is crucial, as trust and reliability are key factors in attracting clients and securing profitable deals.

Furthermore, as a broker, you need to have excellent negotiation skills to ensure that you achieve the best possible outcomes for your clients. This involves finding the right balance between the buyer's and seller's expectations, while also considering market conditions and the overall financial landscape.

Key Factors Affecting Brokerage Profit

Several factors can have a significant impact on your brokerage profit. One such factor is the overall performance of the financial markets. Fluctuations in the market can directly influence the volume and value of transactions taking place. During periods of economic growth, there is often an increase in investment activities, leading to higher brokerage profits. Conversely, during economic downturns, investors may become more cautious, resulting in a decline in brokerage profit.

In addition to market performance, the competitiveness of the brokerage industry also plays a vital role in determining your profit. With the increasing number of brokerage firms in the market, competition has become fierce. To stay ahead, you need to differentiate yourself by offering unique services, tailored investment strategies, and exceptional customer support.

The fees and commissions you charge also impact your brokerage profit. It is important to strike a balance between competitive pricing and ensuring that your services remain profitable. Offering a transparent fee structure and clearly communicating the value you provide to your clients can help justify your charges.

Efficiency in your operations is another key factor that affects your brokerage profit. Streamlining your processes, utilising technology, and minimising operational costs can help maximise your profit margins. By investing in advanced trading platforms and automation tools, you can enhance the speed and accuracy of your transactions, attracting more clients and increasing your overall profitability.

Moreover, building a strong network of clients and maintaining long-term relationships is crucial for sustainable brokerage profit. Repeat business and referrals from satisfied clients can significantly contribute to your overall revenue. Therefore, focusing on customer satisfaction and providing exceptional service is essential for long-term success in the brokerage industry.

Strategies to Increase Your Brokerage Profit

1. Diversifying Your Portfolio

One effective strategy to grow your brokerage profit is by diversifying your portfolio. By offering a wide range of investment products and services, you can attract a larger pool of clients and increase your earning potential. This could include offering options for stocks, bonds, commodities, and real estate, among others. A diverse portfolio not only appeals to a broader audience but also helps mitigate risk.

Diversification is a key principle in investing. By spreading your investments across different asset classes, you can reduce the impact of any single investment's performance on your overall portfolio. For example, if one industry experiences a downturn, having investments in other sectors can help offset potential losses. This approach allows you to capture opportunities in various markets and maximise your potential returns.

Additionally, diversifying your portfolio can provide your clients with more options to meet their investment goals. Some clients may prefer low-risk investments, while others may be more willing to take on higher levels of risk for potentially higher returns. By offering a diverse range of investment products, you can cater to different risk appetites and attract a wider range of clients.

2. Enhancing Your Client Base

Your client base is the lifeblood of your brokerage business, and expanding it is crucial for increasing your profit. Cultivating strong relationships with existing clients is essential, but it is equally important to attract new clients. This can be achieved through targeted marketing campaigns, networking, and referrals. By showcasing your expertise, professionalism, and trustworthiness, you can create a strong brand presence and attract a steady stream of clients.

One effective way to enhance your client base is by providing exceptional customer service. When clients feel valued and well taken care of, they are more likely to refer your brokerage to their friends, family, and colleagues. Word-of-mouth referrals can be a powerful tool for expanding your client base, as people trust recommendations from those they know and respect.

Another strategy to attract new clients is by leveraging digital marketing channels. In today's digital age, having a strong online presence is essential. Utilise social media platforms, create engaging content, and optimise your website for search engines to increase your visibility and attract potential clients. By showcasing your expertise through thought leadership articles, webinars, and educational resources, you can position yourself as a trusted authority in the industry.

3. Utilising Technology for Efficiency

In today's digital world, embracing technological advancements can enhance your efficiency and profitability. Utilising online trading platforms, advanced analytics tools, and automated systems can streamline your operations and reduce manual effort. By leveraging technology, you can serve your clients more effectively, execute trades swiftly, and stay ahead of the competition.

Online trading platforms offer convenience and accessibility, allowing your clients to monitor their investments and execute trades from anywhere at any time. These platforms also provide real-time market data and research tools, empowering your clients to make informed investment decisions. By offering a user-friendly and intuitive trading platform, you can enhance the overall client experience and build loyalty.

Advanced analytics tools can provide valuable insights into market trends, client behaviour, and investment performance. By analysing this data, you can identify opportunities for growth, optimise your investment strategies, and tailor your services to meet the evolving needs of your clients. Additionally, automated systems can streamline administrative tasks, such as account opening, document processing, and compliance, freeing up your time to focus on building client relationships and generating revenue.

Embracing technology is not only beneficial for your brokerage but also for your clients. By leveraging digital innovations, you can provide a seamless and efficient experience, enhancing client satisfaction and loyalty. Staying up to date with the latest technological advancements is essential in today's competitive landscape.

4. Automated Accounting Software

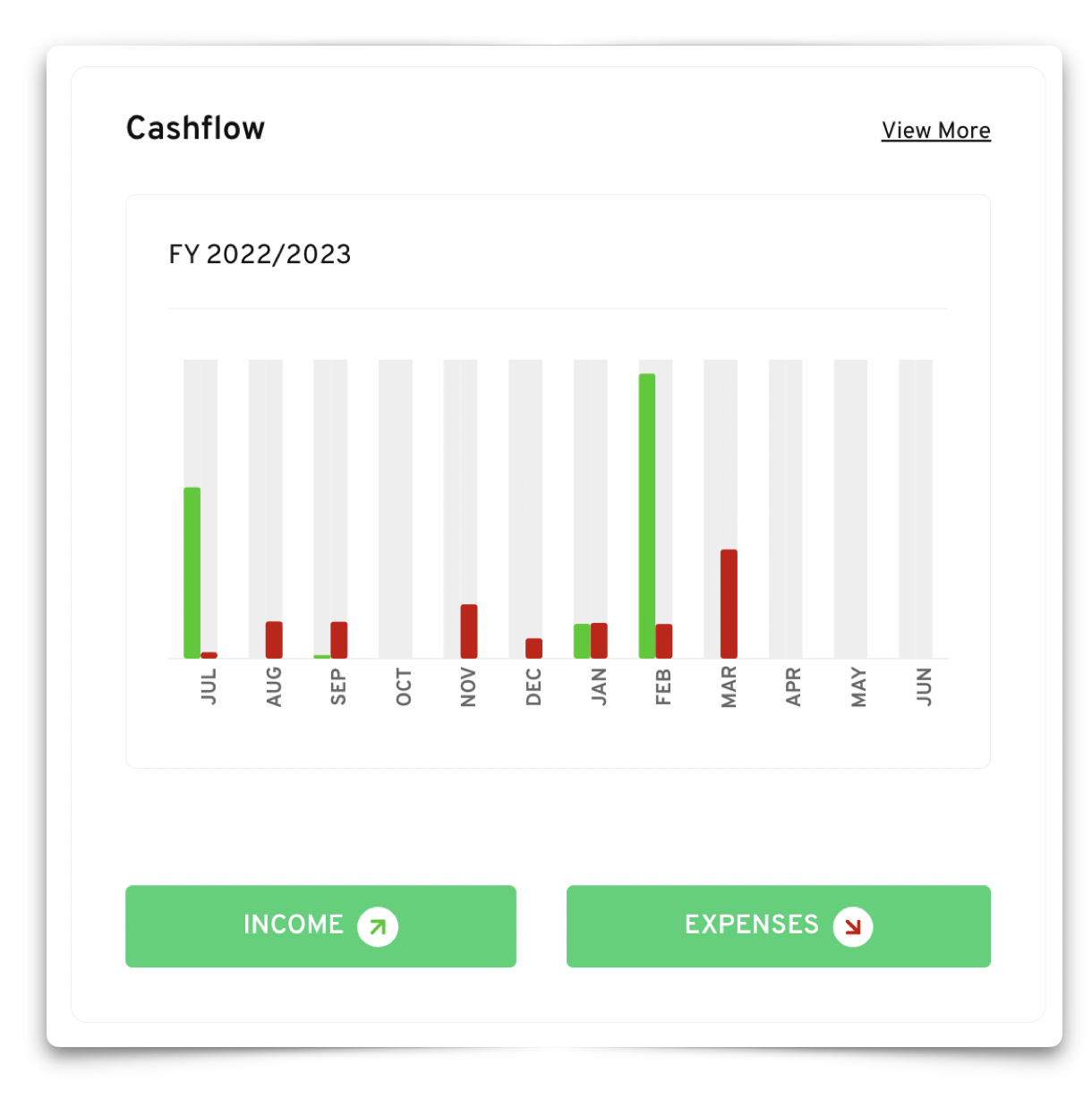

Thriday is the perfect solution for brokers seeking software to save valuable time on financial administrative tasks. With Thriday, brokers can automate various financial processes such as invoicing, payment tracking, and expense categorisation.

The platform seamlessly integrates with banking systems, allowing for efficient transaction management and reconciliation. Thriday's user-friendly interface and intuitive features make it easy to navigate and streamline financial administration.

It also offers comprehensive reporting capabilities, enabling brokers to generate insightful financial reports quickly. By leveraging Thriday's automation and time-saving features, brokers can focus more on client relationships, business growth, and strategic decision-making.

Thriday is the ultimate tool for brokers looking to optimise their workflow and reduce the burden of financial administration. You can join Thriday for free today.

Risk Management in Brokerage

Risk management plays a vital role in the growth and profitability of a brokerage firm. It is an essential practice that allows brokers to understand and evaluate the potential risks associated with different investment opportunities. By conducting thorough risk assessments, brokers can make informed decisions and minimise the likelihood of losses, ultimately safeguarding their profits.

One of the key benefits of risk assessment is the ability to identify potential pitfalls. By carefully analysing the risks involved in various investment options, brokers can gain a comprehensive understanding of the challenges they may face. This knowledge enables them to develop appropriate risk management strategies, ensuring that they are well-prepared to navigate any potential obstacles that may arise.

Diversification is a widely recognised technique in effective risk management. It involves spreading investments across different asset classes and markets. By diversifying their portfolios, brokers can reduce the impact of poor performance in any single investment. This strategy helps to mitigate the risk associated with relying too heavily on a particular investment, ensuring a more balanced and resilient portfolio.

In addition to diversification, setting clear stop-loss orders is another important technique in risk management. A stop-loss order is a predetermined price level at which a broker will automatically sell a security to limit potential losses. By implementing this strategy, brokers can protect themselves from significant downturns in the market, ensuring that losses are minimised.

Hedging strategies also play a crucial role in effective risk management. Hedging involves taking positions in one market to offset potential losses in another. This technique helps to protect brokers from adverse market movements and provides a level of insurance against unexpected events. By utilising hedging strategies, brokers can reduce their exposure to risk and enhance their overall risk-adjusted returns.

Regularly reviewing and updating risk management policies is essential in the ever-changing landscape of the financial markets. Market volatility and new investment opportunities can present new risks that need to be addressed. By staying proactive and adapting their risk management strategies, brokers can stay ahead of market trends and ensure the ongoing protection of their profits.

Building Strong Client Relationships

The Value of Trust in Brokerage

Building trust with your clients is a cornerstone of brokerage profit growth. Trust is earned through transparent and honest communication, delivering on promises, and consistently providing top-notch service. By building strong client relationships based on trust, you enhance customer loyalty, increase referrals, and gain a competitive edge in the market.

Strategies for Client Retention and Satisfaction

Retaining existing clients and ensuring their satisfaction is equally important for growing your profit. Tailor your services to meet individual client needs, provide regular updates and market insights, and offer personalised investment advice. Promptly addressing any client concerns or issues demonstrates your commitment to their success and fosters long-term relationships that are beneficial for both parties.

The Impact of Market Trends on Brokerage Profit

Staying Updated with Market Developments

In the dynamic world of finance, staying updated with market developments is essential. This includes closely monitoring economic indicators, industry trends, and regulatory changes. By staying informed, you can anticipate market movements, identify emerging opportunities, and make timely investment recommendations to your clients. Keeping your finger on the pulse of the market helps you adapt quickly and maximise your profit potential.

Adapting to Market Changes for Profit Growth

Market trends and conditions are constantly evolving, and adapting to these changes is crucial for brokerage profit growth. Whether it's embracing new technologies, adjusting your investment strategies, or exploring new market segments, your ability to adapt allows you to seize opportunities and navigate any challenges that arise. Agility and flexibility are key attributes that will help you stay ahead in the competitive brokerage industry.

In conclusion, growing your profit as a broker requires a comprehensive approach that encompasses understanding the basics of brokerage profit, implementing effective strategies, managing risks, building strong client relationships, and staying updated with market trends. By continuously striving for excellence, providing exceptional service, and always putting your clients' needs first, you can achieve sustained profit growth and establish yourself as a successful broker in the industry.

DISCLAIMER: Team Thrive Pty Ltd ABN 15 637 676 496 (Thriday) is an authorised representative (No.1297601) of Regional Australia Bank ABN 21 087 650 360 AFSL 241167 (Regional Australia Bank). Regional Australia Bank is the issuer of the transaction account and debit card available through Thriday. Any information provided by Thriday is general in nature and does not take into account your personal situation. You should consider whether Thriday is appropriate for you.

.svg)

.svg)