How to Maintain a Sustainable Balance Between Profit and Loss

Few elements wield as much influence over the sustainability and growth of a business as cash flow. Picture it as the lifeblood coursing through the veins of your enterprise, powering every decision and initiative. Yet, despite its pivotal role, cash flow management often finds itself relegated to the backstage of financial discussions. In this blog, we embark on a journey to shed light on the paramount importance of tracking cash flow and unveil the transformative impact it can have on businesses of all sizes. From understanding the rhythm of income and expenses to navigating unforeseen financial twists, join us as we unravel the crucial reasons why vigilant cash flow tracking isn't just a financial chore but the compass guiding your business toward resilience and success.

In today's dynamic business landscape, maintaining a sustainable balance between profit and loss is key to long-term success. One crucial aspect of achieving this balance is effectively monitoring the money flowing in and out of your business. By gaining a deep understanding of your cash flow, you can make informed decisions and take proactive measures to steer your business towards stability and growth.

Understanding the importance of monitoring cash flow

When it comes to managing your business's finances, monitoring cash flow is fundamental. It provides a clear picture of your company's financial health, highlighting the inflows and outflows of money. By tracking cash flow, you can identify potential issues before they become significant problems and take timely action. It also enables you to seize opportunities, make strategic investments, and plan for the future, all while staying in control of your finances.

Monitoring cash flow is like having a compass that guides you through the ever-changing landscape of business. It allows you to navigate through the ups and downs, ensuring that you stay on course towards success. Just as a captain relies on a compass to steer a ship, a business owner relies on cash flow monitoring to steer their company towards profitability and sustainability.

Imagine a scenario where you are sailing through stormy seas. Without a compass, you would be at the mercy of the unpredictable waves, risking your ship and crew. Similarly, without monitoring cash flow, your business could be vulnerable to financial storms that may arise unexpectedly. By keeping a close eye on your cash flow, you can anticipate and prepare for these storms, ensuring that your business remains afloat even in the most challenging times.

Defining sustainable balance between profit and loss

A sustainable balance between profit and loss refers to maintaining a healthy cash flow that keeps your business running smoothly. It means ensuring that the money flowing into your business is more than the money going out. This surplus creates a solid financial foundation, providing you with the resources needed to cover expenses, invest in growth, and weather unforeseen challenges. Striking this equilibrium is essential for long-term success and sustainability.

Think of your business as a delicate ecosystem, where every financial decision has a ripple effect. A sustainable balance between profit and loss is like finding the perfect harmony within this ecosystem. It allows your business to thrive, with the inflow of revenue exceeding the outflow of expenses. This surplus acts as a cushion, protecting your business from unexpected setbacks and allowing you to seize opportunities for growth.

Imagine a garden where you carefully tend to each plant, ensuring that they receive just the right amount of water and sunlight. Similarly, maintaining a sustainable balance between profit and loss requires careful attention to your business's financial health. By nurturing your cash flow, you create an environment where your business can flourish, attracting investors, customers, and opportunities.

The role of money-in and money-out in business sustainability

Money-in and money-out are the lifeblood of any business. Money-in refers to the revenue generated from sales, while money-out represents the expenses and costs incurred in running the business. By effectively monitoring both these aspects, you can safeguard your business's sustainability. It allows you to ensure a steady inflow of revenue while controlling expenses, maintaining healthy profit margins, and avoiding situations that could jeopardise your financial stability.

Imagine a well-oiled machine where every cog and gear works in perfect synchrony. In the same way, money-in and money-out are the gears that keep your business engine running smoothly. When money-in exceeds money-out, your business gains momentum, propelling it towards success. However, if money-out surpasses money-in, it can create friction and hinder your business's growth.

Monitoring money-in and money-out is like fine-tuning the gears of your business engine. It ensures that each component is working optimally, maximising efficiency and reducing waste. By carefully managing your revenue and expenses, you can maintain a sustainable flow of cash, allowing your business to thrive and adapt to changing market conditions.

Imagine a river flowing steadily, nourishing the surrounding land and supporting a diverse ecosystem. Similarly, by effectively monitoring money-in and money-out, you create a financial river that sustains your business and enables it to flourish. This river of cash provides the necessary resources for innovation, expansion, and resilience, ensuring that your business remains competitive in a dynamic marketplace.

Techniques for effective money-in monitoring

Monitoring the money flowing into your business requires a systematic approach. By implementing the right techniques, you can enhance your financial management practices and optimise your revenue streams.

When it comes to effective money-in monitoring, there are several key strategies that can help you stay on top of your finances. From implementing a robust invoicing system to tracking sales and revenue streams, each technique plays a crucial role in ensuring a healthy cash flow and maximising your money-in potential.

Implementing a robust invoicing system

An efficient invoicing system is essential for effective money-in monitoring. Prioritise accuracy and timeliness in generating invoices and ensure that they clearly outline the products or services provided, payment terms, and due dates.

One way to enhance your invoicing system is by personalising your invoices. Adding a personal touch, such as including the customer's name or a brief thank-you note, can go a long way in building strong relationships with your clients and encouraging prompt payments.

Regularly follow up on outstanding payments to maintain a healthy cash flow. Utilise digital tools and software to automate the invoicing process and streamline your financial operations. These tools can help you generate invoices, send payment reminders, and even track the status of each invoice, making it easier to identify any late payments and take appropriate action.

Tracking sales and revenue streams

To monitor money-in effectively, track your sales and revenue streams comprehensively. Keep detailed records of each transaction, including the amount, customer, and date.

One way to gain deeper insights into your sales and revenue streams is by categorising them based on different criteria. For example, you can categorise sales by product type, customer segment, or geographic location. This will allow you to identify trends and patterns that can help you make informed decisions about your business strategies.

Another important aspect of tracking sales and revenue streams is analysing the impact of your marketing efforts. By monitoring the correlation between marketing campaigns and revenue generation, you can determine which strategies are most effective in attracting customers and driving sales.

Regularly review and adjust your strategies based on these insights to maximise your money-in potential. For example, if you notice that certain products or services are consistently generating high revenue, consider allocating more resources towards promoting and expanding those offerings.

In conclusion, effective money-in monitoring requires a combination of techniques, including implementing a robust invoicing system and tracking sales and revenue streams. By prioritising accuracy, timeliness, and analysis, you can ensure a healthy cash flow and optimise your revenue streams. Remember, financial management is an ongoing process, so regularly reviewing and adjusting your strategies is key to long-term success.

Strategies for efficient money-out tracking

Monitoring money-out is just as crucial as tracking money-in. By implementing effective strategies, you can ensure that your business operates optimally within its means, reducing unnecessary expenditures and maintaining a healthy cash flow.

Managing overhead costs and expenses

Overhead costs and other expenses can significantly impact your bottom line. Regularly review your overheads, such as rent, utilities, and insurance, to identify cost-saving opportunities. Explore options for reducing expenses without compromising the quality of your products or services. Effective management of overhead costs ensures that your money-out aligns with your business's financial goals.

Controlling direct and indirect costs

Monitoring and controlling both direct and indirect costs are essential for sustainable financial management. Direct costs directly relate to the production or delivery of your products or services, such as raw materials or outsourced manufacturing. Indirect costs, on the other hand, include expenses not directly tied to production, such as marketing or administrative costs. Regularly assess and optimise your direct and indirect costs to ensure efficient money-out management.

Tools and software for cash flow management

Thanks to modern technology, numerous tools and software solutions are available to help businesses monitor and manage their cash flow effectively. By harnessing new tools like Thriday, you can streamline your financial processes and gain valuable insights to make well-informed decisions.

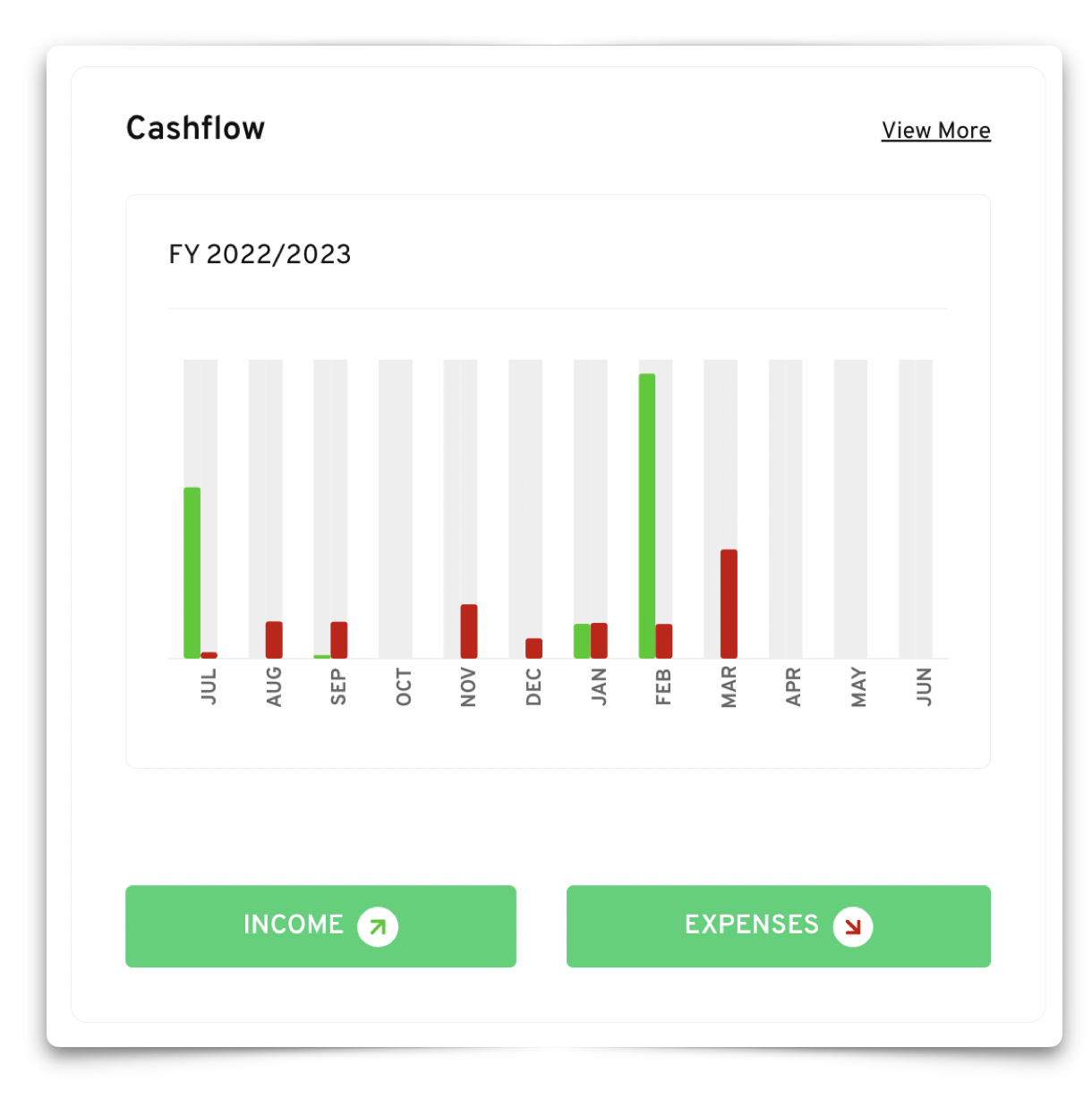

Thriday takes financial visibility to new heights by offering a real-time window into the pulse of your business's cash flow. With a dynamic interplay between actual and predicted cash flow tracking, Thriday empowers users to anticipate financial ebbs and flows with unparalleled accuracy.

Witnessing your income and expenses unfold in real-time provides a level of insight that goes beyond traditional financial management. This proactive approach allows businesses to navigate the financial terrain with confidence, making informed decisions on the fly.

Thriday's commitment to transparency and precision in cash flow management transforms the way businesses perceive and engage with their financial health, ensuring that the heartbeat of success remains straightforward.

Benefits of using digital tools for cash flow monitoring

Digital tools offer numerous benefits when it comes to cash flow monitoring. They provide real-time data, allowing you to track your money-in and money-out accurately. These tools often provide insightful visualisations and reports, simplifying complex financial information for easy interpretation. Additionally, they automate repetitive tasks, reducing the risk of human error and freeing up time for more strategic financial planning.

Selecting the right cash flow management software

Choosing the right cash flow management software is essential to optimise your financial operations. Consider software that aligns with your business's size, needs, and budget. Look for features such as invoicing capabilities, expense tracking, financial forecasting, and integration with other systems. Read reviews, compare options, and take advantage of free trials to ensure that the software you select meets your requirements and seamlessly integrates into your existing infrastructure.

Creating a cash flow forecast for sustainability

A cash flow forecast is a proactive tool that helps you predict and plan for future financial requirements. By creating and regularly updating this forecast, you can better understand your business's financial trajectory and make informed decisions to ensure long-term profitability and sustainability.

Understanding the components of a cash flow forecast

A cash flow forecast has three key components: money-in, money-out, and timing. Money-in represents the projected revenue from sales, while money-out reflects the projected expenses and costs. Timing refers to when these transactions are anticipated to occur. Accurately projecting your money-in and money-out while considering their timing allows you to anticipate potential cash deficits or surpluses and take appropriate action.

Regularly updating and reviewing your cash flow forecast

A cash flow forecast is a dynamic tool that requires regular updating and review. As your business evolves, so do your financial needs and projections. Update your forecast with actual data to compare against your projected figures. This allows you to identify any discrepancies and make necessary adjustments to stay on track. Regularly reviewing and revising your cash flow forecast enables you to adapt to changing market conditions, make informed business decisions, and maintain a sustainable balance between profit and loss.

Monitoring the money-in and money-out of your business is crucial for maintaining a sustainable balance between profit and loss. By gaining a deep understanding of your cash flow, implementing effective monitoring techniques, adopting the right tools and software, and creating a cash flow forecast, you can steer your business towards long-term success and financial stability. Stay vigilant, adapt to changing circumstances, and let your financial insights guide you on the path to growth and prosperity.

DISCLAIMER: Team Thrive Pty Ltd ABN 15 637 676 496 (Thriday) is an authorised representative (No.1297601) of Regional Australia Bank ABN 21 087 650 360 AFSL 241167 (Regional Australia Bank). Regional Australia Bank is the issuer of the transaction account and debit card available through Thriday. Any information provided by Thriday is general in nature and does not take into account your personal situation. You should consider whether Thriday is appropriate for you.

.svg)

.svg)