Profit First - The complete guide for Australian businesses

The Promise of Profit First: “Transform Your Business from a Cash-Eating Monster to a Money-Making Machine.” This definitive guide will walk you through the what, the why and the how of Profit First.

Building a thriving business in Australia takes grit. You secure clients and sell your products & services and revenue flows, yet achieving profitability for many feels like a distant dream. Expenses have a life of their own, constantly rising and eating into potential gains. You reinvest to grow, but the cycle continues, leaving you feeling stuck.

This is where the Profit First method steps in. It's not about chasing revenue. It's a revolutionary approach that flips traditional financial management. It prioritises profitability from the very beginning. By taking control of your cash flow, you build a sustainable business designed to thrive, not just survive.

Read on to know more about it.

What is the Profit First method?

Mike Michalowicz's Profit First is a cash flow management system designed specifically for small businesses. It flips the traditional accounting method on its head by prioritising profit.

Profit First ensures that a portion of your income is allocated towards profit before anything else, rather than waiting to see what's left over after expenses. This shift in mindset can help small businesses become more profitable and financially secure.

Here's the key difference:

Traditional method

Sales - Expenses = Profit

Profit First Method

Sales – Profit = Expenses

Profit First advocates allocating a specific percentage of your revenue to separate accounts for profit, owner's pay, taxes, and operating expenses every time you receive income. This ensures you prioritise profit and build a buffer for unexpected costs or future growth.

Why is the Profit First method so effective?

Profit First's effectiveness goes beyond just changing the order in which you allocate funds. It tackles core psychological and financial roadblocks faced by small businesses. Let's delve deeper.

Behavioural change

Profit First's core strength lies in its focus on separate bank accounts for specific financial goals.

We've all fallen prey to the "spend what you have" mentality. Imagine having a single bank account for business income, personal expenses, and taxes. It's easy to justify larger purchases because the overall balance seems healthy.

Mike Michalowicz uses the analogy of plates.

The more you put on your plate, the more you tend to eat.

Eat in excess, and you become unhealthy.

The same thing happens with money.

Profit First disrupts this pattern by taking a predetermined percentage of your income (your profit) and placing it in a separate account. This creates a mental barrier, forcing you to be more mindful about spending limits with the remaining funds allocated for operating expenses.

To learn more about the psychology behind Profit First watch our latest interview with Mike here:

Focus on profitability

Traditional accounting might tell you your business made $100,000 last year, but what if expenses were $98,000? Profit First forces you to define profit as a specific percentage from the outset. For instance, you might allocate 5% of every dollar earned to your profit account. This constant reminder keeps profitability at the forefront of your business decisions. Imagine two businesses with similar revenue.

The Profit First business owner constantly asks, "How can I optimise operations to increase my 5% profit?". This focus leads to better cost control and a laser focus on activities that drive true profitability.

Simplified cash flow management

Imagine a messy desk with bills, receipts, and bank statements scattered everywhere. That's what your finances can feel like without precise categorisation. Profit First assigns specific accounts to each financial category (profit, owner's pay, taxes, operating expenses). It's like having a filing system for your money.

Your profit account balance tells you exactly how much you've saved towards your goals. This clarity empowers you to make informed financial decisions and avoid the confusion and overspending that can plague traditional methods.

Here's a real-world example:

Sarah runs a graphic design consultancy in Sydney. She struggles with feast-or-famine cycles and worries she's not actually making a profit. After implementing Profit First, Sarah allocates 10% of every invoice to her profit account. This forces her to be more mindful of expenses and identify areas for cost savings.

Within a few months, Sarah has a clear picture of her cash flow, a healthy profit buffer, and the peace of mind to focus on securing new clients and growing her business strategically.

Profit First is backed by research in behavioural economics. Studies show that people are more likely to stick to financial goals when separated into specific accounts, making them feel more tangible. This aligns perfectly with the Profit First methodology.

By addressing these psychological and practical roadblocks, Profit First empowers Australian business owners to break free from the cycle of surviving and finally achieve financial prosperity.

How does Profit First work?

1. Determine your profit margin

Analyse current financials. Before diving in, get a clear picture of your current financial health. Analyse your income statements and identify areas of high spending. This will help you determine realistic profit goals for your Profit First implementation.

Set Your Target Allocation Percentages (TAPs). These percentages dictate how you distribute incoming revenue. Here's a breakdown of the five core accounts typically used in Profit First:

Profit: Start small (ideally 1% to 3%) and gradually increase as your business becomes more efficient. This account becomes your "profit buffer" and a constant reminder of your financial goals.

Owner's compensation: Ensure you pay yourself a fair wage (typically 35% to 50%). This fosters financial stability and incentivises smart business decisions.

Taxes: Allocate a percentage based on your estimated tax obligations (e.g., income tax, GST). This avoids scrambling come tax season and ensures you have readily available funds.

Operating expenses: The remaining funds after allocations to other accounts go here. This account covers essential business expenses (rent, salaries, marketing, etc.).

2. Set up the Profit First accounts

Profit First recommends using separate bank accounts for each category (or sub-accounts within a single bank if that's easier for you). This physical separation fosters a "mental accounting" approach, keeping your profit goals and expenses distinct. Here's what you'll need:

Revenue account: This is your main operating account where all your business income flows in (client payments, product sales, etc.).

Profit account: A designated percentage is automatically transferred from your Sales Account to this account after every sale (daily or weekly transfers are ideal).

Owner's pay account: A predetermined percentage is automatically transferred from your Sales Account to this account, ensuring you receive consistent compensation.

Tax account: Automate transfers from your Sales Account based on your estimated tax bracket.

Operating expense account: This account holds the remaining funds after allocations to the other accounts. Utilise this account for all your business expenses, requiring more conscious spending decisions.

3. Allocate revenue to each account:

This is where the magic happens! Not just any magic but scientifically proven psychological magic but we’ll talk more about that later.

With your accounts established, you'll allocate incoming revenue according to your predetermined TAPs. Here's the flow:

When you receive a payment, transfer the percentage to your Profit Account first.

Then, allocate the percentage for the Owner's pay.

Next, transfer the estimated tax amount to your Tax account.

The remaining funds in your Revenue account represent the Operating expenses available. So transfer them to the Opex account and that’s how much money you have to spend on your business.

4. Pay expenses from the appropriate accounts:

This is where traditional budgeting gets flipped on its head. You only spend what's available in your Operating Expense Account.

Resist the urge to dip into your Profit or Owner's Compensation accounts to cover operating expenses.

This might require temporary adjustments to your spending habits, but remember, the long-term benefits outweigh the short-term discomfort.

As this becomes a habit you’ll get great at thinking outside the box of how to make that Opex account grow and how to stretch the dollars in there further.

You’re essentially turning business into a game.

One that you’ll want to play over and over and over and win.

Profit First percentages

Profit First Percentages, or Target Allocation Percentages (TAPs), are the cornerstone of the Profit First financial management system. They represent the predetermined percentage of your revenue allocated to specific bank accounts, ensuring your business prioritises profitability from the beginning.

The thing is, there needs to be more than a one-size-fits-all approach to TAPs. The ideal percentages for your business will depend on several factors:

- Business model: Service-based businesses typically have higher profit margins than product-based businesses. Brick-and-mortar stores have different overhead costs compared to online businesses. Understanding your unique model helps you allocate funds accordingly.

- Financial stage: A startup might prioritise the owner's pay to reinvest in growth, while a mature business might allocate more towards profit and taxes.

- Industry benchmarks: Research average profit margins and expense ratios within your industry to establish a baseline for your TAPs.

While these are just a starting point, here's a common Profit First percentage breakdown for businesses:

- Profit: 5-10% of revenue

- Owner's Pay: 50% of revenue (or more, depending on your needs)

- Tax: 15-20% of revenue (consider GST if applicable)

- Operating expenses: Remaining percentage of revenue

Remember, these are just guidelines! Analysing your financials and business goals is crucial to determining the most suitable TAPs for your unique situation.

Profit First accounts

Profit First revolves around dedicated bank accounts for specific financial goals. These accounts act as buckets to segregate your business income and ensure clear visibility into your financial health. Here's a breakdown of the core Profit First accounts and some additional options for specialised needs:

Core Profit First Accounts

- Revenue account: This is your central hub, where all your business income streams (sales, invoices, etc.) flow into. Think of it as a temporary holding station before funds are distributed to their designated accounts.

- Profit account: The Heart of Profit First! A predetermined percentage of your revenue is automatically deposited here. This account represents your business's financial wellbeing and acts as a buffer for emergencies, investments, or future growth.

- Owner's pay account: This account holds the percentage of revenue allocated for your living expenses, salary, or drawings. By paying yourself first, you prioritise financial stability and avoid the temptation to overspend from business funds.

- Tax account: This account accumulates funds for tax obligations (income tax, GST, payroll tax).Regularly transferring a portion of your income here ensures you have sufficient funds to cover tax liabilities when due.

- Operating expenses (Opex) account: This account holds funds for ongoing business costs like rent, utilities, software subscriptions, marketing, and supplies. A percentage of your revenue is automatically allocated here to cover these essential expenses.

Remember:

- The ideal allocation percentages for each account will vary depending on your business model, financial stage, and industry benchmarks.

- Regularly review and adjust your TAPs (Target Allocation Percentages) as your business evolves.

- Tools like Thriday simplify Profit First implementation by offering easy account creation and automated fund transfers based on your TAPs.

What’s the best business bank for Profit First?

While any bank can technically be used, traditionally it’s been time-consuming and expensive to set up.

You would need to go to a branch and do a bunch of paperwork for each and every account.

Then you’d have a monthly fee for each of the accounts. People could be spending $70/month just for the privilege of having enough accounts to actually use the method.

With Thriday, we believe so strongly that Profit First is the ultimate cash flow management solution that we’ve built it completely and even automated it for you.

When you become a Thriday member you immediately have the option to set up your Profit First accounts with a single click.

Certain features can significantly enhance your Profit First experience. Here's why Thriday is the perfect fit for your Profit First journey:

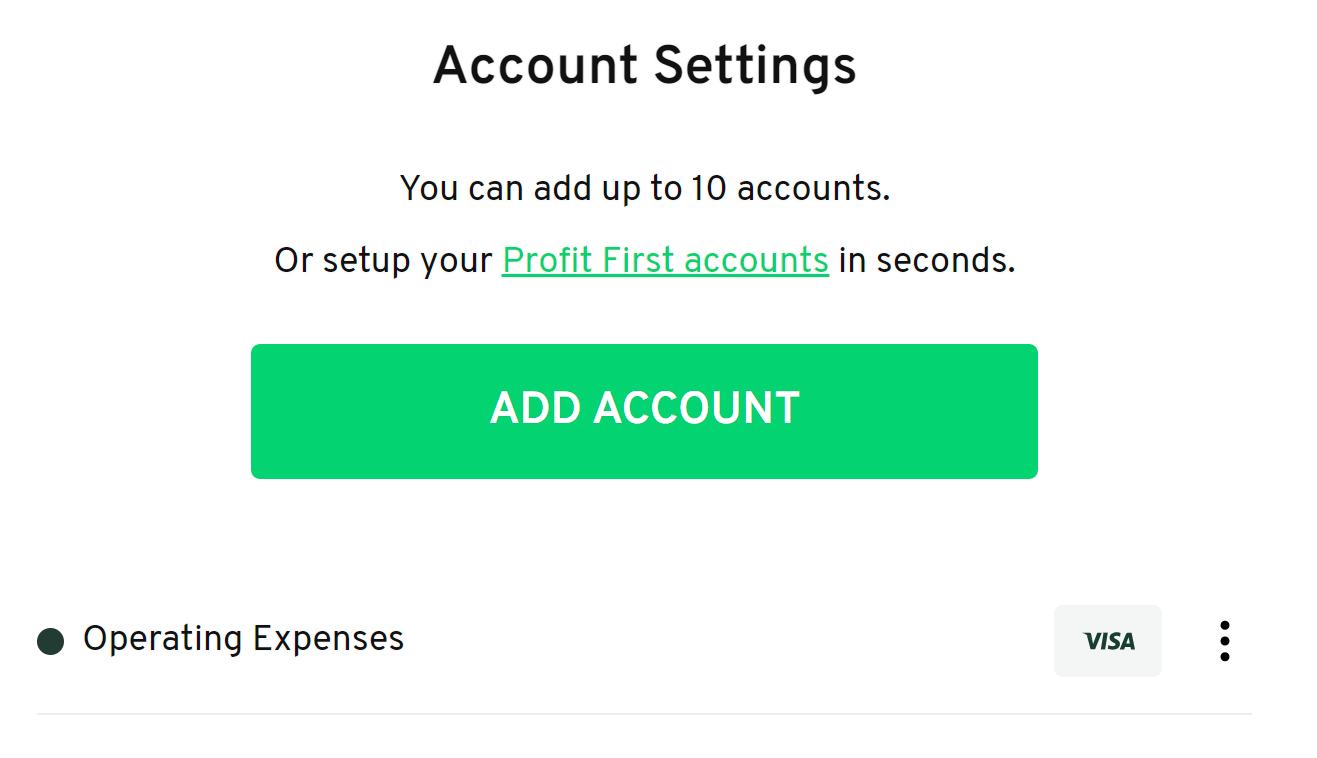

Effortless account creation

Thriday allows you to create up to ten business accounts in just a few clicks. This aligns perfectly with the Profit First methodology's need for multiple segregated accounts.

This process creates the accounts, the target allocation percentages and automates the allocation of money to the different accounts so as soon as you get paid, Profit First just happens, like magic!

Clear account visibility

Each account has its unique BSB and account number, clearly distinguishing between your various financial buckets. This transparency allows you to track each Profit First category's health easily.

Automated transfers

Save time and ensure consistency by setting up automatic transfers based on your predetermined TAPs. Thriday automates the distribution of funds to their designated accounts, minimising manual intervention and potential errors.

The Profit First book doesn’t advocate for automation because the automation of Profit First didn’t exist before Thriday.

Here’s what Mike Michalowicz says about Thriday:

[[Video at time stamp of Mike talking about Thriday]]

Designed for Profit First

Partnership with Profit First Professionals Australia and New Zealand: Thriday actively partners with Profit First Professionals Australia and New Zealand, a network of certified coaches who can guide you through Profit First implementation. This seamless integration allows you to access expert guidance alongside your banking tools.

Community and support: Thriday fosters a community of Profit First users, providing a platform to connect, share experiences, and learn from each other's journeys. This collaborative environment can be a valuable source of support and motivation.

If you want to become part of the Thriday small business community you can join for free here

Focus on financial wellbeing

Real-time Tax Estimates: Gain peace of mind with Thriday's tax estimation feature. This feature provides insights into your projected tax liabilities, allowing you to effectively plan for tax payments and allocate funds accordingly in your Tax account.

Categorisation and Reporting: Thriday automatically categorise transactions, making generating reports that provide a comprehensive view of your income and expenses easy. This granular data lets you identify spending patterns and optimise your financial management.

Ultimately, the "best" bank for Profit First depends on your specific needs and preferences. However, Thriday's features demonstrate a strong understanding of the Profit First methodology and offer functionalities that can significantly streamline your implementation. By considering factors like account management, Profit First-specific features, and overall financial health focus, you can decide on the banking partner that best supports your business's financial journey.

How to set up Profit First in Thriday

1. Open your first Thriday account in just three minutes.

Building a strong financial foundation for your business is crucial. However, traditional banks often make opening a business account a time-consuming and frustrating experience. Paperwork, appointments, and delays can hinder your momentum.

Thriday offers a refreshing alternative. Sign up for your Thriday business account entirely online through their user-friendly website with its Profit First Quick Account Setup. The process is quick and convenient, allowing you to skip the long lines and wasted time associated with traditional banks.

Not to mention the $0 monthly access fee. You can enjoy the benefits of Thriday's platform without worrying about hidden costs.

2. Create your first Profit First accounts

Go to Settings > Accounts > and click the Profit First accounts link

3. Set up recurring, percentage-based transfers

You can set up recurring transfers based on your predetermined TAPs. Thriday automatically distributes funds to their designated accounts at the specified intervals, minimising manual work and potential errors associated with manual transactions. This ensures a consistent and effortless "profit-first" approach to managing your business finances.

After clicking the Profit First accounts link you can edit the target allocation percentages to suit your business, or you can leave them at the default as per the Profit First method.

Important Reminder:

Profit First is not a "set it and forget it" system. Regularly monitor your account balances and review your TAPs. As your business grows and evolves, your financial needs will likely change. Thriday allows you to easily adjust your TAPs and sub-accounts to ensure your Profit First system remains optimised for your ongoing success.

FAQs about Profit First

- Can I customise my Profit First accounts? Yes! In addition to the core accounts, you can create sub-accounts within Thriday to further personalise your Profit First setup for specific goals like a reserve fund, marketing budget, or debt repayment.

- How often should I review my TAPs? The frequency of reviewing your TAPs depends on your business's specific needs and growth rate. Small businesses are advised to review their allocation percentages regularly, such as monthly or quarterly.

- What if I need to adjust my TAPs? Profit First is not a rigid system. As your business evolves, your financial needs will likely change. Thriday allows you to easily adjust your TAPs and sub-accounts to ensure your Profit First system remains optimised for your ongoing success.

- Do I need a separate accounting system with Profit First? While not mandatory, using an accounting system alongside Profit First can provide valuable insights into your business finances. Thriday integrates seamlessly with popular accounting software.

- Will Profit First help my business grow? Profit First can be a powerful tool for business growth. By prioritising profit and ensuring you have a clear financial picture, you can make informed decisions about investments, hiring, and marketing initiatives that can fuel your business expansion. Profit First also encourages a focus on building a financial buffer, providing essential security and flexibility as your business grows.

- Who should use Profit First? It is designed to be beneficial for companies of all sizes and industries. Whether you're a solo trader, a startup, or an established company, Profit First can help you gain control of your finances and achieve your business goals. However, it's important to understand the system and potentially consult with a professional to ensure it aligns with your specific needs.

Our Key Takeaways

Profit First isn't a fad; it's a revolutionary cash flow management system for businesses to smash through the cycle of feast-or-famine cash flow and unlock true financial freedom.

Profit First, Not Last. Unlike traditional methods, Profit First prioritises profit from the get-go. By automatically allocating a percentage to a dedicated "profit" account, you build a buffer and invest in your business's future, even in lean times.

Mindset Shift, Big Wins. Profit First isn't just about numbers; it's about behaviour. Separate accounts for expenses and profit create a mental barrier, encouraging smarter spending decisions and a laser focus on what truly drives your bottom line.

Clarity is Power. Stop feeling like you're drowning in numbers. Profit First assigns each financial category its account, giving you a crystal-clear view of your cash flow. No more scrambling or mystery – just informed financial decisions.

In other words, Profit First is a system built to scale. Whether you're a one-person show or a growing company, it can empower you to transform your financial health and achieve long-term success. Take control, ditch the panic, and build a business that thrives with Profit First and Thriday.

DISCLAIMER: Team Thrive Pty Ltd ABN 15 637 676 496 (Thriday) is an authorised representative (No.1297601) of Regional Australia Bank ABN 21 087 650 360 AFSL 241167 (Regional Australia Bank). Regional Australia Bank is the issuer of the transaction account and debit card available through Thriday. Any information provided by Thriday is general in nature and does not take into account your personal situation. You should consider whether Thriday is appropriate for you.

.svg)

.svg)