The Art of Budgeting for Small Business: A Comprehensive Guide

As a small business owner, budgeting is essential to managing your finances. Creating a budget can help you plan and allocate your resources more effectively, ensure you are on track to achieve your financial goals, and ultimately save you money. This comprehensive guide will cover everything you need to know about budgeting for your small business. From creating a budget to tracking expenses and managing cash flow, we will share tips and best practices to help you become money-wise.

Creating a budget for your small business

Creating a budget for your small business is crucial to achieving financial stability and growth. According to a survey conducted by the Australian Small Business and Family Enterprise Ombudsman (ASBFEO), more than half of small businesses in Australia fail within their first five years, and one of the main reasons for this is poor financial management.

To avoid this fate, creating a budget that accurately reflects your revenue and expenses is essential. Start by identifying your income sources, such as sales revenue, investments, and grants. Next, determine your expenses, including fixed costs such as rent, utilities, and salaries, and variable costs such as supplies and marketing.

Setting realistic budget goals is crucial to ensuring your budget is adequate. While setting goals that challenge you to improve your business is essential, they should also be achievable. By setting unrealistic goals, you risk demotivating yourself and your team, which can lead to poor performance.

Thriday can help you to create a budget that is realistic and achievable. With our automated accounting services, you can accurately forecast your cash flow, identify potential issues before they arise, and make informed financial decisions to help your business grow. Join for free today to get started on your budgeting journey.

Tracking your expenses and revenues

Tracking your expenses and revenues is essential to budgeting for your small business. By keeping accurate financial records, you can identify areas where you may be overspending, adjust your budget accordingly, and make more informed financial decisions.

In Australia, small businesses must keep records of their financial transactions for at least five years. This includes all income, expenses, receipts, assets, and liabilities. Accurate financial records are crucial for tax purposes, and failure to keep them can result in fines and penalties from the Australian Taxation Office (ATO).

To keep accurate financial records, consider using accounting software like Thriday. Our automated accounting services can help you track expenses and revenues, generate financial reports, and automate your bookkeeping processes. This can save you time and effort while ensuring that your financial records are accurate and up-to-date.

By tracking your expenses and revenues, you can also identify potential issues before they become significant problems. For example, if your costs are increasing faster than your revenues, you may need to adjust your budget or find ways to increase your sales. Thriday can help you to identify these issues and provide insights that can help you to make informed decisions about your business.

Analysing your budget and making adjustments

Analysing your budget and adjusting it is an integral part of budgeting for your small business. By regularly reviewing your budget, you can identify areas where you may be overspending or need to invest more resources. This can help you to make informed financial decisions that will help your business to grow.

According to research by Thriday, a leading accounting software provider in Australia, 65% of small businesses in Australia do not update their budgets regularly. Failing to manage budgets can lead to outdated financial information, making it difficult to make informed decisions about your business.

Reviewing your budget regularly and making changes as needed is essential to avoid this problem. For example, if your expenses are higher than expected, you may need to cut back on certain costs or find ways to increase your revenue. Conversely, if your income is higher than expected, consider investing more in marketing or expanding your product line.

Thriday can help you improve your profitability by making implementing the Profit First method easy. With Thriday, you can easily set up multiple bank accounts* and allocate a portion of your business revenue towards profit, taxes, and other expenses, ensuring the business is consistently profitable.

In the next section, we'll discuss the importance of managing your cash flow and how Thriday can help you to improve your cash flow management.

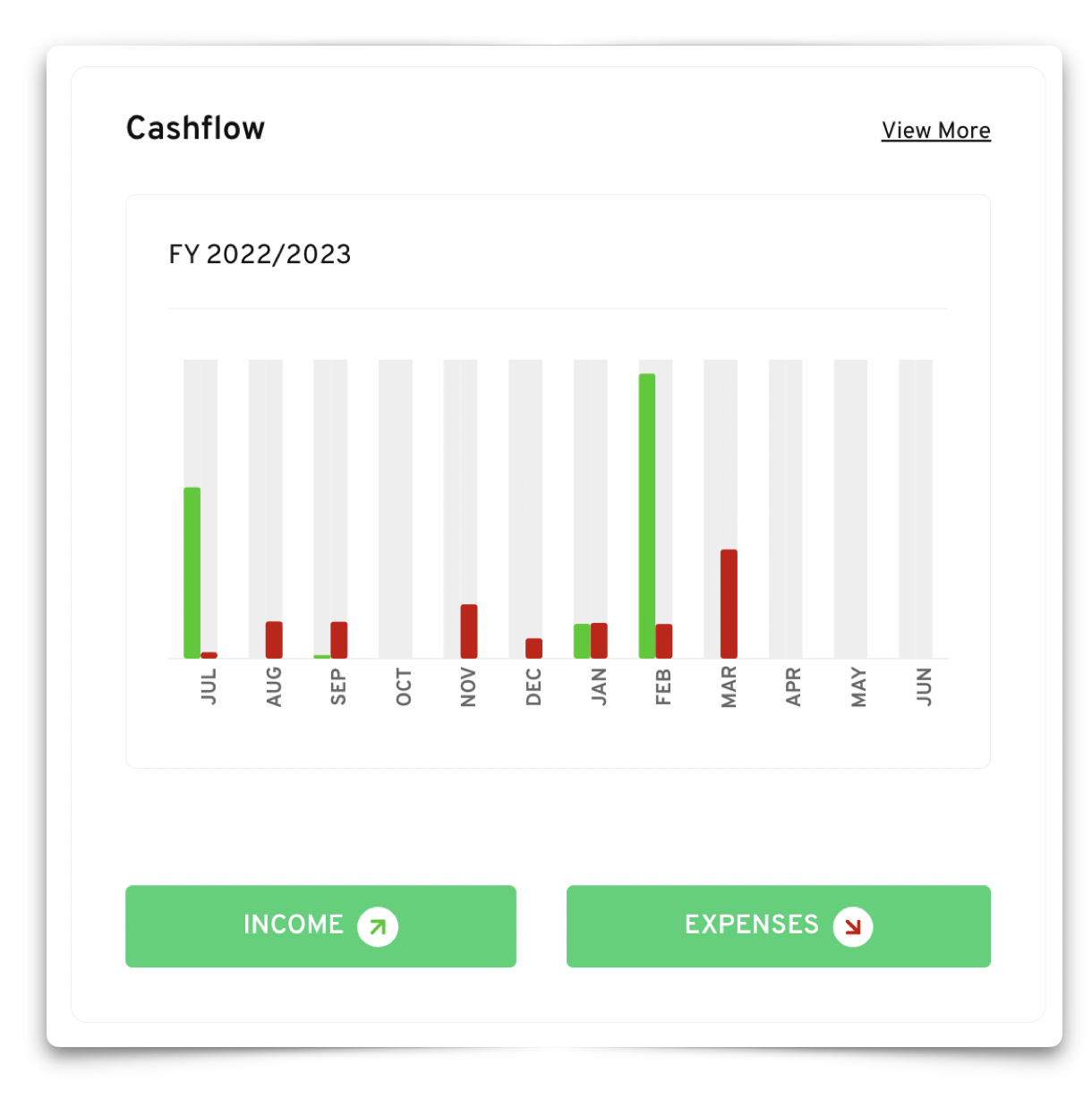

Managing cash flow

Managing cash flow is essential for small businesses in Australia. Cash flow refers to the amount of money coming in and going out of your business and is a critical measure of financial health. According to research by the Australian Securities and Investments Commission (ASIC), inadequate cash flow is one of the top reasons small businesses fail in Australia.

To improve your cash flow, it's important to keep track of your income and expenses, monitor your accounts receivable and payable, and have a plan in place for managing any unexpected costs.

Thriday's automated accounting services can help you to manage your cash flow effectively. Our software provides real-time financial insights, allowing you to see exactly where your money is going and make informed decisions about your business. Our software also provides tools for automating your accounts receivable and payable, so you can ensure you're getting paid on time and paying your bills promptly.

Budgeting is a crucial aspect of managing a small business in Australia. It allows you to keep track of your finances, plan for the future, and make informed decisions about your business. By creating a budget, tracking your expenses and revenues, analysing your budget, and managing your cash flow, you can ensure your small business's financial stability and success.

At Thriday, we understand the challenges that small businesses face when managing their finances. That's why we've developed automated banking, accounting and tax services designed to help small enterprises to become money smart. Our software provides real-time financial insights, automates bookkeeping and accounting, and allows you to manage your cash flow more effectively. To find out how much time you can save on financial admin with Thriday, take this time saver quiz.

Join Thriday for free today to start budgeting smarter and taking control of your small business finances. With Thriday's automated accounting services, you can focus on growing your business while we handle the bookkeeping and accounting. Don't let finances hold you back from reaching your business goals. Let Thriday help you become a money wizard and achieve financial success.

DISCLAIMER: Team Thrive Pty Ltd ABN 15 637 676 496 (Thriday) is an authorised representative (No.1297601) of Regional Australia Bank ABN 21 087 650 360 AFSL 241167 (Regional Australia Bank). Regional Australia Bank is the issuer of the transaction account and debit card available through Thriday. Any information provided by Thriday is general in nature and does not take into account your personal situation. You should consider whether Thriday is appropriate for you.

.svg)

.svg)